south san francisco sales tax 2019

New city economic nexus standard One significant change was the adoption of an economic nexus standard for select city taxes and for its business registration fee. 305 Dna Way South San Francisco CA 94080.

South San Francisco California Ca 94080 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

This property is currently available for sale and was listed by REMAX International on Jan 11 2022.

. Welcome to 3655 Bassett Ct a spacious 4 bed 2 b. The minimum combined 2022 sales tax rate for San Francisco California is 863. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

4 beds 2 baths 1820 sq. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax. San Franciscos payroll expense tax was set to fully phase out in 2018 after the phase-in of the Citys gross receipts tax.

The partial exemption rate is 39375 percent making the partial sales and use tax rate equal to 45625 percent for San Francisco County and 53125 percent for South San Francisco San Mateo County. If passed by the voters Measure FF would first increase the Citys TOT rate to 12 effective January 1 2019. The December 2020 total local sales tax rate was 9750.

The current Conference Center Tax is 250 per room night. The sales tax jurisdiction name is San Francisco Tourism Improvement District which may refer to a local government division. The December 2020 total local sales tax rate was 8500.

San Francisco Controller issues payroll expense tax rate for 2019. Without Measure W the total sales tax in the city would have continued at 9 percent75 percent mandated by the state and a 15 percent sales tax. San Francisco is in the following zip codes.

In light of the COVID-19 public health crisis and shelter-in-place orders in effect in San Francisco the sale scheduled for May 1 2020 through May 4 2020 has been cancelled. 1788 rows South Dos Palos. Information and Tax Returns for the collection of Transient Occupancy Tax and Conference Center Tax in South San Francisco is available below.

South San Francisco CA. Things I Need to Know or Do BearBuy Form to Use Other Useful References. Sales Tax State Local Sales Tax on Food.

The beautifully bright and spacious living and family rooms feature Jerusalem recessed lighting and elegant finishes. The current Transient Occupancy Tax rate is 14. Auction Site bid4assets Timeshare Parcels.

Auction Site bid4assets Parcels Other Than Timeshares. For tax rates in other cities see. Sales Tax Breakdown South San Francisco Details South San Francisco CA is in San Mateo County.

The measure was designed to transfer the sales tax revenue amounting to about 7 million per year into the citys general fund to be used for any government purpose. The California sales tax rate is currently 6. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Acampo 7750 San Joaquin Acton 9500 Los Angeles Adelaida 7250 San Luis Obispo Adelanto 7750 San Bernardino. The MLS for this home is MLS ML81874084. Effective January 1 2019 the city of San Francisco adopted major changes to its business tax laws after voters approved Proposition D in the 2018 election.

Real property tax on median home. The San Francisco sales tax rate is 0. The combined rate used in this calculator 9875 is the result of the California state rate 6 the 94002s county rate 025 the Belmont tax rate 05 and in some case special rate 3125.

House located at 3655 Bassett Ct SOUTH SAN FRANCISCO CA 94080 sold for 1138888 on Aug 15 2019. Payroll tax of 328 on payroll expense attributable to the City5 Commercial Rents Tax Effective January 1 2019 San Francisco joins the New York City borough of Manhattan in imposing a commercial rents tax6 Unlike Manhattan San Franciscos Commercial Rents Tax will be imposed on the landlord not the. San Francisco CA Sales Tax Rate San Francisco CA Sales Tax Rate The current total local sales tax rate in San Francisco CA is 8625.

The County sales tax rate is 025. Sales Tax State Local Sales Tax on Food. Tax returns are required monthly for all hotels and motels operating in the city.

South El Monte 10250. 850 Is this data incorrect The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025 county sales tax and a 225 special district sales tax used to fund transportation districts local attractions etc. Did South Dakota v.

How 2022 Sales taxes are calculated for zip code 94002. 94080 94083 94099. South San Francisco CA Sales Tax Rate The current total local sales tax rate in South San Francisco CA is 9875.

You can print a 9875 sales tax table here. Real property tax on median home. Persons other than lessors of residential real estate are required to file a return if in the tax year you were engaged in business in San Francisco were not otherwise exempt and you h ad more than 2000000in combined taxable San Francisco gross receipts.

2019 Public Auction. Subsequently the ballot measure would then increase the Citys TOT rate to 13 effective January 1 2020. This is the total of state county and city sales tax rates.

Exemption provisions are listed in Section 954The most common exemption is for certain non-profit organizations. There is no applicable city tax. The ballot measure would also authorize an additional 1 each year to a maximum TOT rate of 14.

The 94002 Belmont California general sales tax rate is 9875. About 24 Vista Court South San Francisco CA 94080. What is the sales tax rate in San Francisco California.

When Does the California Partial Sale Tax Exemption Apply. Sales Tax Breakdown San Francisco Details San Francisco CA is in San Francisco County. The City of San Francisco City has issued the payroll expense tax rate for 2019 which is unchanged from the prior year at 0380.

South San Francisco is in the following zip codes. 715 AC MOL PARCEL 1 PARCEL MAP VOL 7871-72. The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax.

Fully remodeled home with gorgeous panoramic views of the San Francisco Bay with picture windows that will stop you in your tracks the moment you walk through the front door. 3732 Fairfax Way 9A South San Francisco CA 94080 is a 3 bedroom 2 bathroom 1115 sqft townhouse built in 1971. South San Francisco CA.

South San Francisco California Ca 94080 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

South San Francisco California Ca 94080 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

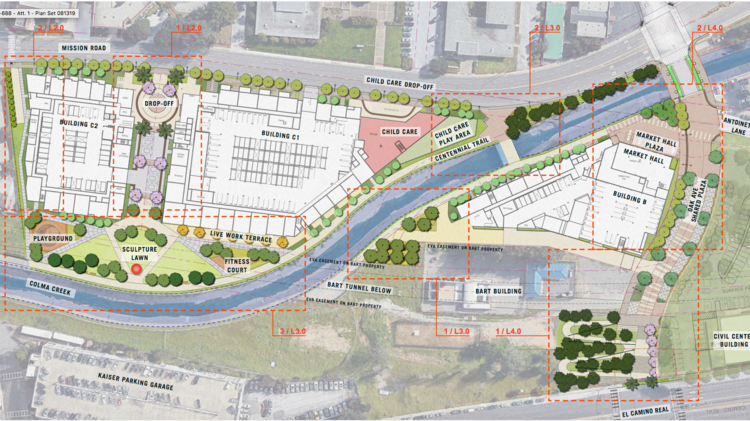

South San Francisco Approves 800 Homes Near Bart At 1051 Mission St San Francisco Business Times

Car Rentals In South San Francisco From 34 Day Search For Rental Cars On Kayak

South San Francisco California Ca 94080 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Economy In South San Francisco California

South San Francisco California Ca 94080 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

South San Francisco California Ca 94080 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

South San Francisco Approves 800 Homes Near Bart At 1051 Mission St San Francisco Business Times